Get the free loan assumption addendum

Show details

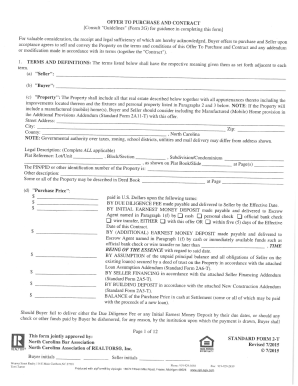

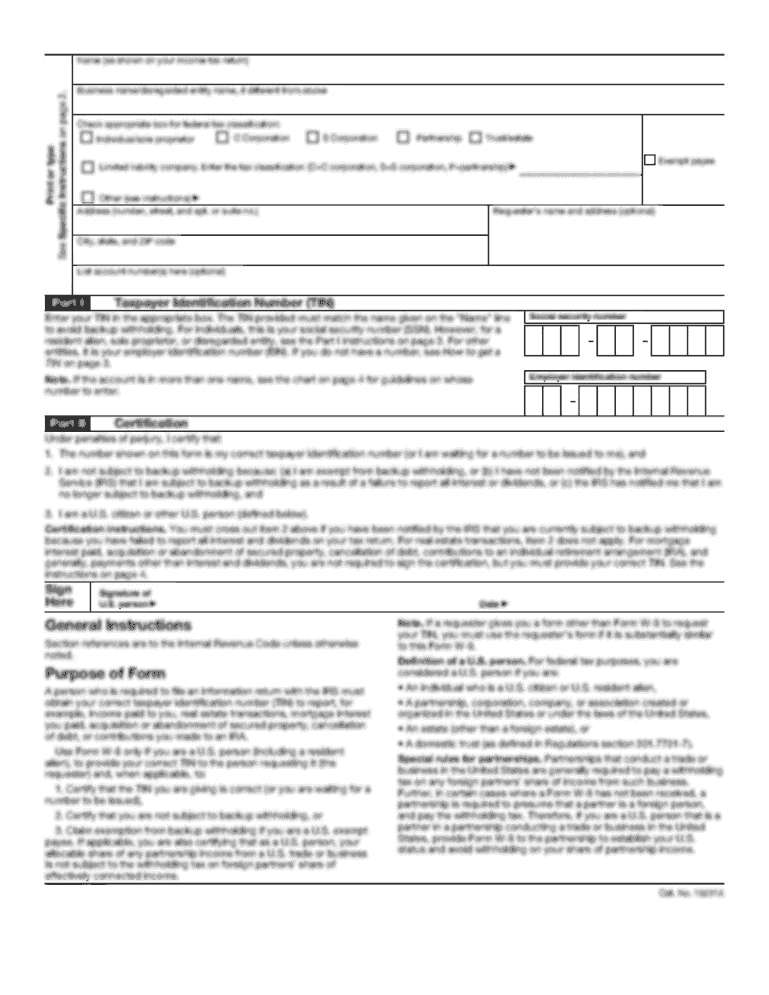

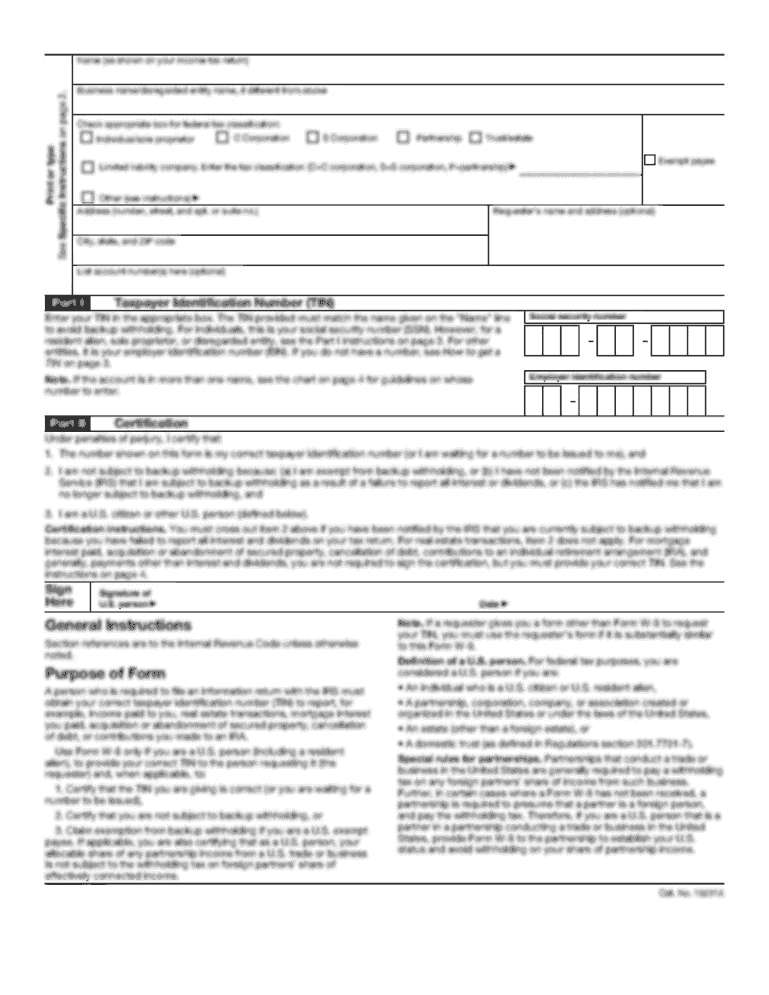

41-1 Loan Assumption Addendum Concerning Page 2 of 2 released on delivery of an executed release by noteholder. PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION TREC 04-23-07 EQUAL HOUSING OPPORTUNITY LOAN ASSUMPTION ADDENDUM TO CONTRACT CONCERNING THE PROPERTY AT Address of Property A. CREDIT DOCUMENTATION* To establish Buyer s creditworthiness Buyer shall deliver to Seller within days after the effective date of this contract credit report verification of employment including salary current...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trec loan assumption addendum form

Edit your loan assumption addendum trec form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas real estate site pdffiller com site blog pdffiller com form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing assumption of loan agreement online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loan assumption addendum form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan assumption addendum form

01

To fill out a loan assumption addendum, you should start by reviewing the terms and conditions of the original loan agreement. This will help you understand the specific requirements and guidelines for completing the addendum accurately.

02

Gather all the necessary documentation and information related to the loan assumption. This may include the original loan agreement, proof of income, personal identification, and any other supporting documents requested by the lender.

03

carefully read through the loan assumption addendum form. It is essential to understand each section and the information it requires. Pay attention to any fields that need to be filled out, such as borrower information, property details, and financial statements.

04

Ensure that all the information you provide on the addendum is accurate and complete. Double-check the spellings of names, addresses, and other vital details.

05

If you are completing the loan assumption addendum as the new borrower, you may need to provide additional documentation such as a credit report, employment verification, and bank statements to demonstrate your financial capability to assume the loan.

06

Once you have filled out the entire addendum form, carefully review it for any errors or omissions. It is crucial to ensure the accuracy and completeness of the information provided.

07

After reviewing the completed addendum, sign and date the document in the designated areas. If there are other parties involved, such as co-borrowers or guarantors, make sure they also sign the necessary sections.

Who needs a loan assumption addendum?

01

Individuals or businesses that are taking over an existing loan from another borrower may need to fill out a loan assumption addendum. This is commonly seen in real estate transactions where a new buyer assumes the existing mortgage on a property.

02

Lenders may require a loan assumption addendum to be completed to ensure that all relevant parties are aware of and agree to the transfer of the loan.

03

In some cases, loan assumption addendums may also be used in loan refinancing or modification situations, where the terms and conditions of the original loan agreement are being altered.

Overall, anyone involved in a loan assumption or loan transfer situation should consult with their lender or legal professional to determine if a loan assumption addendum is necessary and to ensure that it is correctly filled out.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to qualify for an assumable mortgage?

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

Can you assume a mortgage from a family member?

Mortgage: Federal law requires lenders to allow family members to assume a mortgage if they inherit a property. However, there is no requirement that an inheritor must keep the mortgage. They can pay off the debt, refinance or sell the property.

How is a loan assumption documented?

The most important document in the loan assumption process is the deed of trust, which adds your name to the mortgage and absolves the original borrower of any obligations under the agreement, assuming a novation. All parties will be required to sign the final documents.

What is a loan assumption addendum?

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

How do I assume a family member for a mortgage?

You can transfer a mortgage to another person if the terms of your mortgage say that it is “assumable.” If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

Who signs for the assumption of a mortgage?

When you assume a mortgage, the current borrower signs the balance of their loan over to you, and you become responsible for the remaining payments. That means the mortgage will have the same terms the previous homeowner had, including the same interest rate and monthly payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my loan assumption addendum form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your loan assumption addendum form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit loan assumption addendum form online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your loan assumption addendum form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete loan assumption addendum form on an Android device?

Use the pdfFiller mobile app to complete your loan assumption addendum form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is loan assumption addendum?

A loan assumption addendum is a legal document that allows a buyer to take over the seller's existing mortgage loan. This addendum outlines the terms and conditions under which the buyer assumes the mortgage.

Who is required to file loan assumption addendum?

The seller of the property and the buyer assuming the loan are required to file the loan assumption addendum. Additionally, the lender may also require documentation.

How to fill out loan assumption addendum?

To fill out a loan assumption addendum, both parties must provide their personal information, loan details, and any applicable terms of the assumption. It usually requires signatures from both the buyer and seller, as well as the lender's approval.

What is the purpose of loan assumption addendum?

The purpose of the loan assumption addendum is to legally document the transfer of responsibility for a mortgage loan from the original borrower to the new borrower, ensuring that all terms of the original loan remain in effect.

What information must be reported on loan assumption addendum?

The loan assumption addendum must include information such as the names of the parties involved, details of the existing loan (amount, interest rate, and terms), and any conditions that apply to the assumption of the loan.

Fill out your loan assumption addendum form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Assumption Addendum Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.